.png)

.png)

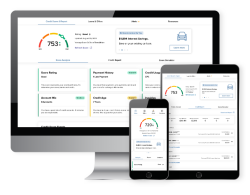

Your Credit Score and more at your fingertips

With one powerful tool, access your credit score and full credit report, monitor your credit and get financial tips. All of this without impacting your credit score.

You can do this anytime and anywhere for FREE.

Benefits of Credit Score:

- Daily access to your credit score

- Real-time credit monitoring alerts

- Credit Score Simulator

- Personalized credit report

- Special credit offers

- and more!

Keep your credit score front and center.

Tracking your credit score is easier than ever - it can now be displayed right on your Online and Mobile Banking dashboard. By staying in touch with your score, report and monitoring updates, you put yourself in the best position to truly discover financial freedom.

Enroll today to find your score.

1. Login

Log into Online or Mobile Banking

2. Find

Look for

Credit Score & Report

3. Enroll

You're all set!

What is Credit Score by SavvyMoney?

Credit Score by SavvyMoney is available through online and mobile banking. It is a free service to help you understand your credit score by giving you access to your full credit report. Additionally, you have access to financial tips and education, credit offers based on your credit score, a credit score simulator, credit monitoring alerts and more!

Will accessing Credit Score by SavvyMoney 'ding' my credit and lower my credit score?

No. Checking your score on Credit Score is a “soft inquiry” which does not affect your credit score.

Is there a fee to use Credit Score by SavvyMoney?

There is no fee. Credit Score is a free service provided to CCU members with online and mobile banking access.

How can I enroll in Credit Score by SavvyMoney?

Log into your online or mobile banking. Find the Credit Score and Report widget and click Show My Score.

How do I unenroll from Credit Score by SavvyMoney?

Go to the Resources tab within Credit Score, select Profile Settings, and then click on Deactivate Credit Score Account.

Can I dispute an error on my credit report through Credit Score by SavvyMoney?

Yes, select Start A Dispute button on the Credit Report page to file a dispute with TransUnion.

Will Co-op Credit Union use Credit Score by SavvyMoney to make loan decisions?

No, Co-op Credit Union will continue to use our lending criteria when making final loan decisions as we have no access to an individual's credit score through SavvyMoney.

How do I turn off the email notifications from Credit Score by SavvyMoney?

Go to the Resources tab within Credit Score, select Profile Settings, and then click Email Notifications.

Why is my credit score from Credit Score by SavvyMoney differ from other credit score offerings?

There are three major credit reporting bureaus—Equifax, Experian, and Transunion—and two scoring models—FICO or VantageScore— that can be used to determine credit scores. Financial institutions use different bureaus, as well as different scoring models. There are over 200 factors within a credit report that may be used when calculating a score, and each model may weigh credit factors differently. Hence, no scoring model is completely identical but should directionally be similar.

How often is my score updated within Credit Score by SavvyMoney?

Your score will be updated automatically every 7 days and be displayed within your online or mobile banking. You can manually refresh your score and full report every 24 hours by clicking Refresh Score and navigating to the detailed Credit Score Dashboard within online and mobile banking.

This project is being funded in part by the Wisconsin Credit Union Foundation, Inc. in support of it's The Difference Initiative efforts.