Rich History. Bright Future.

Co-op Credit Union’s roots date back to the 1930s. Through growth, changes and a commitment to continuous improvement, CCU is proud of its history and ready and excited for the future as it continues the credit union philosophy of "People Helping People."

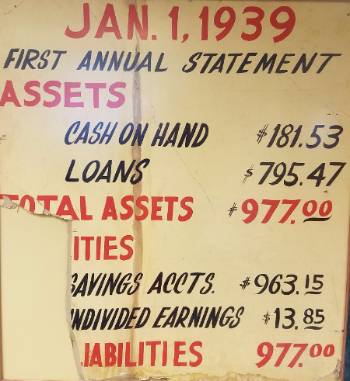

CCU was formed by members of Federation Cooperative in Black River Falls and received its charter from the Wisconsin Banking Commission on July 14th, 1938. Rural electrification had taken place. Consumers wanted credit to pay for new electric appliances. As of January 1st, 1939, total assets were $977.00.

Once CCU outgrew the small two-room office on Harrison Street near Federation Co-op, the credit union moved to 16 S. First St., and in 1969 moved to its newly-constructed building on Fillmore Street.

Growth continued. At the end of 1979, assets totaled just over $10 million. In the autumn of 1980, technological advancements allowed additional services of share draft (checking) accounts, IRAs, money funds and certificates.

In 1981, the Melrose Credit Union merged with Co-op Credit Union, resulting in further growth and additional services available to Melrose-area members. A building addition in Black River Falls created more office space and added drive-up and walk-up service in 1983. At the end of 1984, assets totaled $27 million.

In early 1987, Co-op Credit Union qualified for and obtained federal deposit insurance from the National Credit Union Administration. Later in the year, the credit union underwent another expansion project. At the end of 1987, assets totaled $35.8 million.

In 1990, Galesville Co-op Credit Union merged with CCU. Galesville Co-op Credit Union’s leadership sought checking and other services that could be offered to the members by a larger credit union.

A drive-up branch was constructed on Highway A in Black River Falls and opened on October 27, 1992. Earlier in 1992, CCU topped $50 million in total assets and stood at $53 million at year end. This placed CCU in a group of the 23 largest credit unions in Wisconsin. In April of 1993, an ATM and debit card were added to the list of services. In June of 1993, the Father’s Day Flood came within a half-block of affecting the CCU main office. CCU employees had busily moved vital documents from the building before the waters crested.

In September of 1994, Blair Credit Union merged with Co-op Credit Union. The nearly 300 members affected became introduced to an increased number of credit union services which CCU’s size allowed it to provide. In 1996, Co-op Credit Union served more than 9500 members with total assets topping $65 million.

CCU broke ground in 1999 for a new main office building in Black River Falls at 100 East Main St. at the east end of the bridge, which is where the headquarters remains today. CCU reached the $100 million asset level in 2000 after nearly one full year in its new main office.

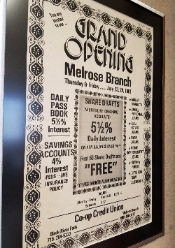

A new Melrose branch office was built in 2005. Just west of the current building, the construction did not interrupt business. The move took place by staff on Saturday afternoon, May 7th – the new building opened for business Monday, May 9th. A grand opening was held in June.

In 2010, Partners Credit Union merged with CCU and with it came an expanded field of membership and two new office locations in Strum and Fall Creek.

In 2015, La Crosse Area Postal Credit Union merged with CCU. The credit union broke ground for a new Onalaska branch office location in 2015, and the location opened in May 2016, allowing CCU to better serve new and existing members in the La Crosse and Onalaska area.

CCU today has more than 22,000 members and more than $500 million in assets. The credit union remains committed to its roots while looking to the future to best serve its members and communities.

In 2024, La Crosse Burlington Credit Union merged with CCU and with it came an expanded field of membership and a new office location in La Crosse.

For People - Not Profit.

We are here to serve our members, where they are, through all stages of life.